摘 要

近年来,依托计算机技术和数据处理技术的发展,财务共享服务在解决机构臃肿、组织人员冗余、管理成本高、信息流不通畅等问题方面的优势日益凸显."财务共享中心" 的建立实施有利于大型集团公司推动财务战略升级转型,更多的企业正在不断探索实施,为集团型企业带来机遇的同时,也出现了很多挑战.

本文以 X 集团财务管理为研究对象,综合运用文献资料、实际调查、案例分析等研究方法,深入的分析了该公司财务管理的具体情况.首先,概括了本文的研究背景,概述了国内外研究现状,阐述了规模经济、资源配置理论、流程再造理论及财务共享的相关理论及优势.其次,以 X 集团公司为例分析问题,从机构及人员设置、资金管理及核算管理等方面对 X 集团公司在财务管理的现状进行剖析,并分析出其中存在的问题,包括资金管控力度不足、财务运营成本高、财务信息反馈不及时等.再次,提出构建财务共享中心这一解决思路,从建设目标、建设内容、组织及人员建设、IT 设施建设等方面剖析财务共享中心的具体实施并进行效益分析.完善保障措施以保障该项目的顺利实施.

最后总结本文结论:财务共享中心的建立可以有效加强内部管控,提升管理水平,共享平台的建立可以实现低成本高效率的数据整合,促进管理水平和效益的提高.

关键词 集团型公司,财务共享中心,构建

Abstract

In recent years, relying on the development of computer technology and dataprocessing technology, the advantages of Financial Sharing Service in solving theproblems of overstaffed organization, redundant organization personnel, high managementcost and unsmooth information flow are increasingly prominent. The establishment andimplementation of "Financial Sharing Center" is conducive to the promotion of financialstrategy upgrading and transformation of large group companies. More enterprises areconstantly exploring the implementation, bringing opportunities for group enterprises, butalso many challenges.

This paper takes the financial management of X Group as the research object, andcomprehensively uses the research methods of literature, practical investigation and caseanalysis to analyze the specific situation of the company's financial management. First ofall, it summarizes the research background of this paper, summarizes the research status athome and abroad, and expounds the relevant theories and advantages of scale economy,resource allocation theory, process reengineering theory and financial sharing. Secondly,taking x group company as an example, this paper analyzes the current situation of Xgroup company's financial management from the aspects of organization and personnelsetting, capital management and accounting management, and analyzes the existingproblems, including insufficient capital management and control, high financial operationcost, and untimely financial information feedback, etc. Thirdly, the paper puts forward thesolution of Building Financial Sharing Center, analyzes the specific implementation ofFinancial Sharing Center from the aspects of construction goal, construction content,organization and personnel construction, it facilities construction and so on, and makesbenefit analysis. Improve the safeguard measures to ensure the smooth implementation ofthe project.

Finally, the conclusion of this paper is summarized: the establishment of FinancialSharing Center can effectively strengthen internal control, improve management level, andthe establishment of sharing platform can achieve low-cost and efficient data integration,and promote the improvement of management level and efficiency.

Key words Group company;Financial sharing center;Construction

目 录

摘 要 ························································································· I

Abstract ························································································ II

第 1 章 绪 论 ····················································································· 1

1.1 研究背景 ···················································································· 1

1.2 研究的目的及意义 ········································································ 1

1.3 国内外研究现状 ··········································································· 2

1.3.1 国外研究现状 ········································································· 2

1.3.2 国内研究现状 ········································································· 4

1.4 研究的思路和方法 ········································································ 7

1.4.1 研究思路 ··············································································· 7

1.4.2 研究方法 ··············································································· 7

1.5 研究的内容 ················································································· 8

第 2 章 财务共享理论基础 ······································································ 9

2.1 财务共享理论概述 ········································································ 9

2.1.1 共享服务 ··············································································· 9

2.1.2 财务共享服务 ········································································· 9

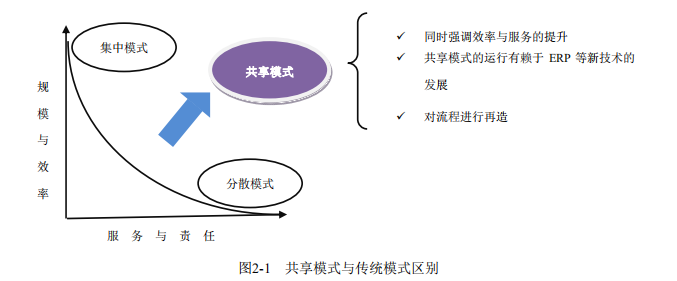

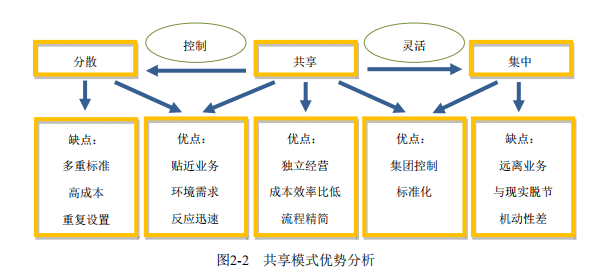

2.1.3 财务共享服务于传统业务模式区别 ············································· 10

2.2 相关理论概述 ············································································· 11

2.2.1 规模经济 ·············································································· 11

2.2.2 资源配置理论 ········································································ 12

2.3.3 流程再造理论 ········································································ 12

第 3 章 X 集团公司财务管理现状 ···························································· 15

3.1 X 集团公司的基本情况 ································································· 15

3.2 X 集团公司财务现状及问题 ··························································· 16

3.2.1 财务机构及人员设置 ······························································· 16

3.2.2 财务管理现状 ········································································ 16

3.2.3 X 集团财务管理现存问题 ························································· 17

第 4 章 X 集团公司财务共享中心构建 ······················································ 19

4.1 财务共享中心构建的目标 ······························································ 19

4.1.1 统一信息化系统 ····································································· 19

4.1.2 成立两级财务共享中心 ···························································· 19

4.1.3 建成会计处理和数据管理中心 ··················································· 20

4.2 财务共享中心业务流程建设内容 ····················································· 20

4.2.1 规则体系建设 ········································································ 20

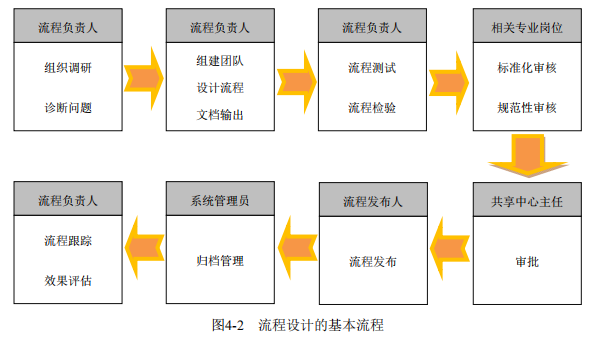

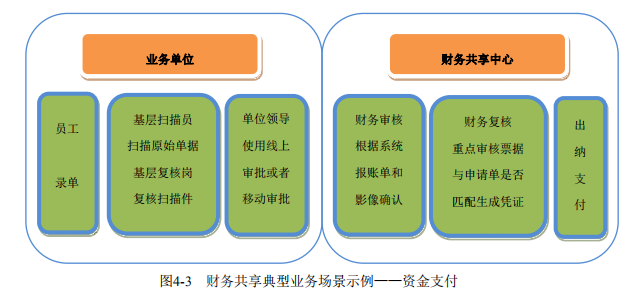

4.2.2 流程体系建设 ········································································ 22

4.2.3 信息化共享平台建设 ······························································· 27

4.3 财务共享中心组织人员建设 ··························································· 29

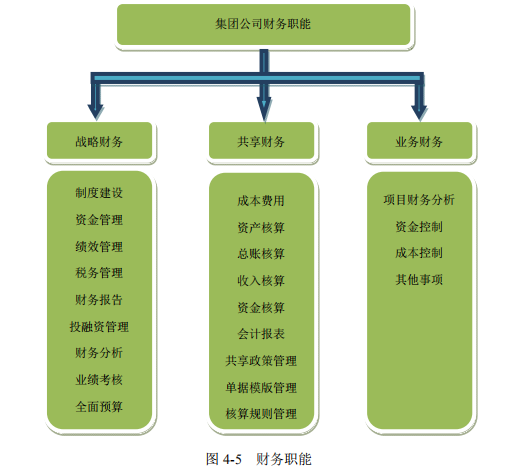

4.3.1 财务共享中心组织建设 ···························································· 29

4.3.2 财务共享中心人员建设 ···························································· 30

4.4 IT 基础设施建设 ·········································································· 30

4.5 成本效益分析 ············································································· 31

4.5.1 人员成本节约收益 ·································································· 31

4.5.2 财务共享服务平台对现状改变对比 ············································· 32

4.5.3 管理效益提升 ········································································ 33

第 5 章 构建财务共享中心保障措施 ························································· 35

5.1 完善前期准备 ············································································· 35

5.1.1 扭转传统财务观念 ·································································· 35

5.1.2 明晰权责关系,完善沟通机制 ··················································· 35

5.1.3 财务共享中心选址 ·································································· 35

5.1.4 防范系统风险 ········································································ 35

5.1.5 进行项目评估 ········································································ 36

5.2 强化内部控制体系 ······································································· 36

5.2.1 完善内部控制制度 ·································································· 36

5.2.2 建立内部员工信用等级制度 ······················································ 36

5.2.3 内部稽核管理 ········································································ 37

5.3 整合组织人力资源 ······································································· 37

5.3.1 财务人员转型及完善 ······························································· 37

5.3.2 加强员工培训和管理 ······························································· 37

结 论 ······················································································· 39

参考文献 ······················································································ 43

致 谢 ························································································· 47

个人简历 ····················································································· 49

第 1 章 绪 论

1.1 研究背景

财务共享中心的创建是财务转型的必然趋势,可以有效加强管控,有效防范风险,提升财务治理能力.

随着经济全球化程度的不断提升,信息技术的更新换代,我国社会经济实现了快速发展,企业借助于改革开放的东风其规模和分支机构也不断增加,传统的财务管理模式已经逐渐落后,无法适应当前经济发展的需求,导致管理成本、管理难度、财务风险增加,财务决策执行力度降低.财务共享服务不同于传统财务管理模式,是一种先进的财务管理方式,诞生于西方发达国家,随着跨国企业逐渐进入国内,很多大型企业引入了财务共享服务模式,此种模式借助于信息化技术,能够对财务业务流程进行全面有效处理,能够为内外部客户提供专业化服务,财务共享服务模式目的是为了实现组织结构优化、管理效率提升,同时能够通过流程的有效控制,实现管理成本的最优化.财务共享中心从本质上看,通过财务共享中心集中处理各业务部门业务的过程,由财务共享中心对此进行统一处理,有利于实现资源的最优配置.

在调查中发现,当前财富500强企业基本上已经全部实现了财务共享服务中心管理,艾森哲公司也对此进行调查,选取了30家财务共享服务中心跨国公司作为研究对象,研究的结果表明,这些公司财务运作成本因此降低了30%.财务共享服务在提升组织效率、节约成本等方面作用非常明显,同时能够解放大量的财务人员,推动了财务组织结构的进一步发展和完善.

我国集团公司财务共享服务中心建设尚处于初级阶段,当前的建设力度不足,建设过程中存在的各种问题,无法满足集团公司财务转型战略升级的需求,因此对此进行深入研究,有利于推动财务共享中心建设的进一步深入.

1.2 研究的目的及意义

财务共享中心最早由福特公司于20世纪80年代在欧洲建立,通过将公司业务中具有共有性、重复性、可标准化的业务集中到共享平台进行统一处理,提高管理效率的同时还可以降低管理成本.在经济全球化等时代背景下,财务共享中心作为一种现代化的财务管理方法,其成效非常明显,因此迅速的在全球范围内推广开来,理论界和实务界对此关注度非常高,有关此方面的研究越来越多.

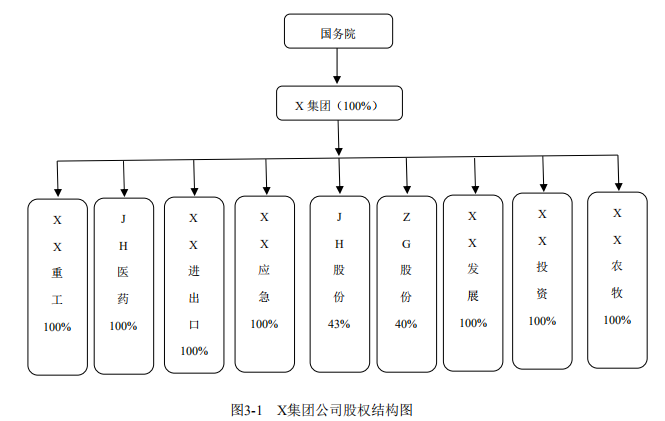

X集团公司作为国务院国资委监管的中央企业,现已形成冶金、轻纺、装备、医药、应急、服务六大业务板块、九大二级公司纵向管控格局,所属各级子企业200余家,组织机构庞大造成财务管控不到位、人员冗余、效率低、成本高、信息系统不协调等现状.因此,建立和实施财务共享中心有利于X集团提高管理水平和盈利能力,促进企业发展.

理论意义:我国关于财务共享服务相关理论研究起步较晚,在理论及案例分析研究上需要完善,本文梳理了国内外相关财务共享中心理论文献,总结适用于大型企业集团的理论内容,为企业内部管控提供新的思路和方式.结合新时代背景下科技进步,丰富财务管理研究维度,促进企业财务管控模式进一步完善和发展.

现实意义:国内很多大型企业和大型集团公司为了提高自身现代化管理能力,纷纷建立起了财务共享中心,并且取得了明显成效,比如华为、中兴通讯等等.但是和西方发达国家大中型企业财务共享中心相比,我国在此方面显然处于起步阶段,缺少充足的经验,未来的发展之路依然漫长.本文选择了X集团公司作为研究对象,希望能够通过对该公司财务共享中心构建方面的问题进行研究,提高企业集团财务共享中心的建设能力,为其他企业集团构建财务共享中心构建提供借鉴.

1.3 国内外研究现状

1.3.1 国外研究现状

针对财务共享服务研究,国外学术界的研究起步比较早,已经有30多年的研究历史,形成了大量的研究成果,特别是在以下几方面已经形成了丰富的理论体系,包括概念、演变模式、流程管理等等.上世纪80年代,国外学术界首先提出了共享服务的概念,美国福特公司率先引入了这一理念,在经营管理过程中建设并实施了共享中心.

Danna Keith & Rebecca Hirschfield(1996)认为,通过财务共享中心,能够实现企业分散业务内容的有效整合,由独立性较强的实体组织对各种分散业务进行统一处理,有利于实现业务处理的自由化,而可以根据管理业务的多少收取相关的费用[1].

Grant and Delvin(1999)深入的分析了多个财务共享中心的实践案例,得出的结论是,只有具备以下5个因素,财务共享中心的功能才能得以充分发挥,一是人,二是信息技术,三是内外部环境,四是企业变革的愿景,五是BPR 应用方法[2].

Kagelman 和 Schulman(2000)根据流程再造理论,深入的分析了共享服务中心的优势,共享服务中心能够将企业内部分散的资源集中起来,进行统一调配和统一管理,从而发挥经济规模效应.此种模式能够实现企业内部资源的自由配置,能够让企业取得更多的经济效益[3].

Denburgh(2000)深入的分析了财务共享服务的优势.特别是在重大事项处理过程中,使用财务共享服务,能够让公司更加灵活的处理问题,很多跨国公司就是通过财务共享服务中心实现自身的快速发展[4].

Deloitte咨询和国际数据(2000)选取了《Fortune》500强企业中的50家企业作为研究对象,深入的分析此类企业在财务共享服务方面的情况,分析的结果表明,实施财务共享服务,企业员工人数平均减少了26%,并且获得了27%的平均投资回报率.

Quinn(2001)对共享服务的发展演变历程进行了全面梳理和总结,共享服务经历了一个从低到高的发展阶段,其类型共有4种,包括基本模式、市场模式、高级市场模式及独立经营模式[5].

Bryan Bergeron(2003)从合作战略的角度对共享服务进行了研究,他认为,共享服务事实上是结合了企业部分经营职能,有一个半自主的业务单元统一对此进行处理,该业务单元直接为企业内部客户提供服务.除此之外,还可以进入市场,和其他的财务共享服务中心开展竞争,设置财务共享服务中心目的体现在三个方面:一是创造价值,二是实现成本的最优化,三是不断提高服务质量[6].

Janssen and Joha(2008)研究的重点是财务共享服务实施过程中的关键因素,具体包括以下几个方面,一是实施严厉的战略,二是重新设计业务内容,三是构建标准化的业务流程,四是建立完善的信息系统,五是对企业进行全面革命性管理[7].

Daniel C. Melchior Jr(2009)在研究中深入的分析了共享服务日常工作的内容,具体包括,一是服务共享的概念和功能,二是服务共享中心建设,三是组织架构、团队和费用分摊等等[8].

Derven(2011)深入的分析了关键因素风险控制方面的问题,他认为,财务共享服务实施的重点体现在以下几方面,一是企业要和客户的目标相一致,二是要提升企业知识管理水平,三是要创立优秀的企业文化,四是要强化流程标准,五是要定期进行绩效考核[9].

Martin(2011)通过问卷调查的方法分析了财务共享方面的问题,通过线性回归模型对于相关数据进行分析,对假设因子进行检验,研究的结果表明,财务共享服务成功的关键因素包含6个方面,一是科学选址,二是制定完善的战略规划,三是实施全流程管理,四是对于传统管理模式进行变革,五是优化组织结构,六是提高客户服务水平[10].

Bramante(2013)在调查中发现,财务部门60%的时间被一些一般性事物所占据,只有20%的时间才能用于专业性财务服务,只有15%的时间用于最重要的决策支持服务.根据上述数据可以看出,这种管理模式实际上是严重浪费了财务部门的人力物力和财力,财务共享模式在缩短财务部门工作量方面作用非常明显[11].

Poter(2013)等人对全球500强企业进行了调查,调查的结果表明,当前正在应用共享服务的企业占70%以上,正在实施共享服务的跨国公司所占比重为90%以上.共享服务在降低成本方面作用非常明显,美国和欧洲成本平均降低率分别达到了50%、35%~40%[12].

…………由于本文篇幅较长,部分内容省略,详细全文见文末附件

结 论

随着经济全球一体化程度的不断加深,信息技术的不断更新换代,企业管理思想发生了巨大调整,商业环境在不断的变化,企业财务也不能一成不变,只有创新才能实现发展.财务共享服务就是其中的一种创新方式,将各分支机构中的非关键性财务业务全部集中在共享中心进行统一、标准化和流程化管理.

和传统的财务管理相比,财务共享服务利用互联网技术对资源、数据和信息等等实施全面科学化管理,解决了总公司和分公司之间各种矛盾和权力冲突,促进了集团公司管理质量和水平的提高.

财务共享中心能够提升集团公司的管控能力,实现公司更快的发展.共享平台是一个信息化平台,能够高效率的对各类数据跨部门跨地域实现有效整合,并且成本低,具有天然的管控优势,有利于企业集团管控能力和效率的提升.财务共享中心利用规模经济效益,能够实现企业管理成本的最优化,该中心已经通过作业流水线,对于财务工作进行流水线般的管理,财务人员可以通过专业化分工,负责流水线上的一个环节,处理好该环节的财务工作,即便是业务量进一步增加,也能满足会计业务处理方面的要求,从而取得规模效应.企业利用此种管理模式既能够实现业务的有效融合,又能够促进其规模的不断扩张.财务共享中心其性质体现在服务方面,通过为内部单元提供财务和信息管理等方面的服务,实现企业的更快发展.特别是新企业或者企业的新业务,无需增加人员配备就可以实现灵活运营.

本文详细的研究和探讨了财务共享中心构建方面的问题,但是受到时间的限制,再加上本人能力有限,本论文得出的结论在深度和广度方面还有所欠缺.另外,本文就选择了 X 集团公司作为研究案例,得出的结论普适性有限,实施方案尚存不足之处,在具体应用过程中要根据个体特性进行调整.

参考文献

[1] Donna Keith, Rebecca Hirschfield.The Benefits of Sharing. HR Focus, 1996, 73(9): 15-16

[2] Grant D A . Using existing modeling techniques for manufacturing process reengineering: a casestudy. Computers in Industry, 1999, 40(1): 37-49

[3] Triplett A, Scheumann J. Managing shared services with ABM. Strategic Finance. 2000, (8):40-45

[4] Van Denburgh E. Doing More With Less. Electric Perspectives, 2000, 25(1): 44-55

[5] Barbara Quinn, Robert Cooke, Andrew Kris 着, 郭蓓译. Shared Services--Mining For CorporateGold. 昆明: 云南大学出版社, 2001

[6] 伯杰龙. 共享服务精要: Essentials of shared services. 北京: 中国人民大学出版社, 2004

[7] Janssen M , Joha A . Emerging shared service organizations and the service-oriented enterprise:Critical management issues. Strategic Outsourcing An International Journal, 2008, 1(1): 35-49

[8] 丹尼尔?C.梅尔基奥尔. 服务共享: 管理者之旅. 大连: 大连出版社, 2009

[9] Derven, M. Advancing the Shared Services Journey Through Training. 2011, 4(9): 58-64

[10] Martin, W. Critical Success Factors of Shared Service Projects--Results of an EmpiricalStudy. Advances in Management, 2011, 14(15): 21-26

[11] Bramante, Martin H, James L. Shared Services: Adding Value to the business Units. John Wiley& Sons, Inc, 2013

[12] Poter G, Robert F, Stephen B. Major Companies are Reengineering Their Accounting Functions.Management Accounting, 2013: 12-15

[13] 张颖. 服务共享中心在现代企业中的价值和发展. [复旦大学硕士学位论文] 上海: 复旦大学, 2002

[14] 刘汉进. 共享服务的决策、实施与评价研究. [上海交通大学硕士学位论文] 上海: 上海交通大学, 2004

[15] 柯明. 财务共享管控服务模式的探讨. 会计之友(上旬刊), 2008, (12): 62-64

[16] 梁军花, 袁宏词. 内部供应链管理视角下的财务共享体系搭建. 现代企业, 2008, (11): 56-57

[17] 李嘉. 集团企业实施财务共享服务路径探讨. 财会通讯, 2009, (23): 69-70

[18] 李春雨, 朱先军. 财务共享中心模式分析与研究. 经营管理者, 2009, (24): 81

[19] 陈虎. 财务共享服务. 北京: 中国财政经济出版社, 2009

[20] 周昌志. 企业集团建立共享财务中心初探--以中国人寿保险集团为例. 法制与经济,2010, (5): 100-102

[21] 何瑛, 周访. 我国企业集团实施财务共享服务的关键因素的实证研究. 会计研究, 2013,(10): 59-66

[22] 李赛娟. 基于 ERP 的财务共享服务中心设计. 财会月刊, 2013, (15): 74-75

[23] 张育强. 财务共享模式下的会计档案管理工作探究. 会计之友(中旬刊), 2010, (12): 52-53

[24] 杨雅莉. 论财务共享服务中心实施与研究. 财会研究, 2014, (9): 28-29

[25] 黄庆华, 杜舟, 段万春. 财务共享服务中心模式探究. 经济问题, 2014, (7)

[26] 钟瑞. 集团公司"财务共享中心"的构建及未来发展研究--以 A 企业为例. [首都经济贸易大学硕士学位论文] 北京: 首都经济贸易大学, 2017

[27] 陈剑, 梅震. 构建财务共享服务中心. 北京: 清华大学出版社, 2017

[28] 邓春梅, 赵冲. 基于多视角的国内外财务共享服务中心比较分析. 财务与会计, 2018, (17):50-53

[29] 李媛媛. 中央企业财务共享服务中心建设的实践与探索. 管理观察, 2018, 698(27): 160-161

[30] 董志鑫. 浅析企业集团财务共享服务中心构建的策略. 时代金融, 2018, 694(12): 95-96

[31] 吴怡平. 集团型企业财务共享服务视角下管理会计信息化研究. 全国流通经济, 2019, (24)

[32] 方婧颖. 企业财务共享服务中心建设的风险与控制研究. 时代金融, 2019, (6): 154-155

[33] 刘玲. A 公司财务共享服务优化研究. [郑州大学博士学位论文] 郑州: 郑州大学, 2018

[34] 顾成露. XD 集团财务共享服务中心构建研究. [安徽财经大学硕士学位论文] 蚌埠: 安徽财经大学, 2017

[35] 田莉杰, 刘冰, 刘丽. 财务共享服务中心在我国企业有效运行的保障措施研究. 青岛科技大学学报(社会科学版), 2018, 34(03): 36-40